Vistry CEO Resigns After Cost Overruns in Southern Division

In a significant turn of events, Greg Fitzgerald, the chief executive officer of Vistry, a prominent UK housebuilding firm, has offered to step down following a revelation about severe cost overruns in its southern operations. This announcement comes amid news that the financial impact of the miscalculation is even greater than initially anticipated, causing the company’s shares to plummet by another 15% on Friday.

Fitzgerald approached the board after an unexpected disclosure last month concerning a staggering £115 million underestimation in the expenses of nine development projects located in southern England.

However, Vistry warned on Friday that an internal investigation suggests the actual shortfall could reach £165 million. This substantial error has led to a revised outlook for this year, which will see profits fall significantly short of shareholder expectations, and has further delayed ambitious medium-term goals initially set to attract investors.

Sources close to the situation indicated that Vistry’s board has declined Fitzgerald’s resignation proposal. A spokesperson for the company opted not to provide any comments regarding the matter.

The ramifications of the financial mishap were evident on the stock market, with Vistry shares dropping by 135.5 pence, or 15.5%, to a low of 738 pence, with the value nearly halved over the last five weeks.

Tracing its history back to the 1800s, Vistry was formed in 2020 from the merger of Bovis Homes and the housebuilding division of Galliford Try. While the company still participates in building homes for the open market, the majority of its current projects involve creating properties for partnerships with local authorities and housing associations.

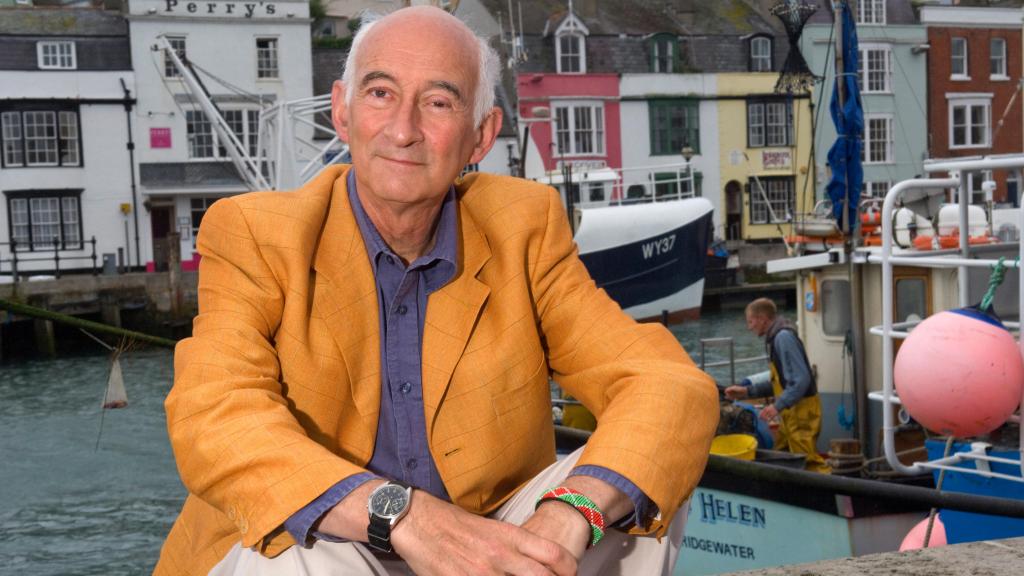

Under Fitzgerald’s direction, who serves as both CEO and executive chairman at 60 years old, Vistry shifted its focus to partnership-based projects last year. This approach theoretically provides more stable revenues, as partners commit to purchasing homes upfront, which was effective in boosting Vistry’s production and profitability compared to conventional rivals struggling in a sluggish housing sector.

Recently, however, developments took a downturn. Due to the underestimations in the southern division, Vistry’s adjusted pre-tax profit is expected to hover around £300 million. Prior to the October warning, management had aspired to achieve approximately £430 million in profits.

Furthermore, the company highlighted that, compounded by distractions from the southern issues and decreasing demand from housing associations and large landlords, they will construct 500 fewer homes than anticipated in 2024. Rising building costs are also a concern as they review potential overspending on cladding.

In addition to adjusting forecasts for the current year, analysts have significantly reduced profit projections for 2025 and 2026. Clyde Lewis, an analyst at Peel Hunt, remarked that this update represents a critical setback in the short term.

Insight: Leadership Under Scrutiny

Fitzgerald’s dual role as executive chairman and CEO had previously raised eyebrows in the City, as this combination is often deemed against best practices in corporate governance. His consolidation of power indicated strong control over the company, and for over 40 years, Fitzgerald has built a solid reputation within the industry.

A former colleague noted, “He’s regarded as a revered figure in the field, having generated substantial returns for many.” Until last month, Vistry shares had risen nearly 60% since Fitzgerald took the helm in April 2017.

Much of this increase stemmed from his strategy to predominantly sell homes to housing associations and institutional landlords, such as Blackstone, aiming to catalyze profits and return substantial amounts to shareholders.

Fitzgerald maintains his conviction that he can achieve these objectives, although even his staunchest supporters acknowledge the challenges ahead. As turmoil emerges, stakeholders anticipate renewed scrutiny on his leadership structure.

In summary, Fitzgerald faces a daunting task in restoring confidence among investors. Despite successfully guiding Vistry into the FTSE 100 earlier this summer, consecutive profit warnings now cast doubt on its standing, with a return to the FTSE 250 looming.

Post Comment